Effective July 1, 2024, the final Overtime Exemptions Rule was released by the DOL impacting executives, administrative and professional employees, and outside sales staff.

How It Impacts Your Business

The final rule updates and revises the provisions of the Fair Labor Standards Act (FLSA) exempting executive, administrative, and professional employees from minimum wage and overtime requirements.

For an employee to be exempt from the FLSA minimum wage and overtime requirements, the employee must generally meet the following three tests:

- Salary Basis Test: Employee is paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality or quantity of worked performed.

- Salary Level Test: The amount of salary paid to the employee must meet a minimum specified amount.

- Duties Test: The employee must perform executive, administrative, or professional duties.

The final rule:

- Increased the salary level test amounts but did not modify the salary basis test or the duties test provisions.

- Increased the amounts the regulations provide as an alternative test to the salary level test for certain highly compensated employees who are paid a salary, earn above a higher total annual compensation level, and satisfy a minimal duties test. Employees meeting the requirements of the alternative test, are also exempt from the FLSA overtime and minimum wage requirements.

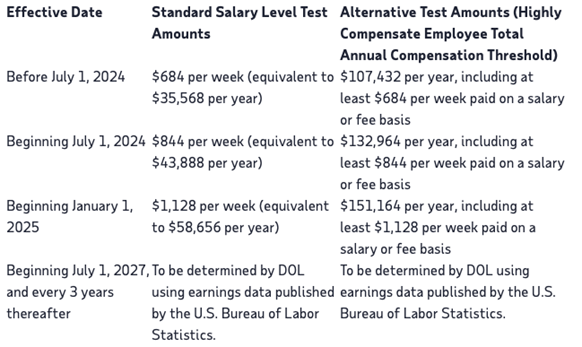

2024 Salary Level Test Amounts

The current amounts and future amounts that an employee must be paid to meet the salary level test and the alternative test to be exempt from the FLSA overtime and minimum wage requirements. View the full list.

Bonuses and Incentive Payments

Up to ten percent of the salary amounts noted in the chart may be satisfied through the payment of non-discretionary bonuses, incentive, and commission payments that are paid annually or more frequently.

However, if by the end of the year the amount paid to the employee is less than 52 times the required salary amount, the employer must make one final payment sufficient to meet the required level no later than the next pay period after the end of the year.

Action Items

- Review additional information and Frequently Asked Questions from DOL.

- Prior to July 1, 2024, review the salary amounts paid to any employees who are currently treated as exempt from the FLSA overtime and minimum wage requirements.

- Determine if the compensation employees are receiving is sufficient to meet the upcoming increase to the salary level test or alternative test amounts.

- If the amounts are not sufficient, determine whether to increase the employee’s salary sufficient to meet the required amount or begin to treat the employee as an FLSA non-exempt employee entitled to the FLSA overtime and minimum wage protections.

- Several states have their own test for exempt status. These tests are typically harder to satisfy. You should apply both the state and federal tests to determine an employee’s status under both federal and state law.

- If you reclassify employees as non-exempt, ensure that managers are prepared to manage overtime costs and understand what hours are considered hours worked. For example, under certain circumstances, travel time and time spent performing preliminary or postliminary activities can be deemed compensable work time.

- Keep in mind that an employee’s “regular rate of pay” for FLSA overtime calculation purposes is the average hourly rate calculated by dividing the total pay for employment (except the statutory exclusions) in any workweek by the total number of hours actually worked. Total pay includes for example, commissions and non-discretionary bonuses.

- If employees are reclassified as non-exempt, then their pay frequency might also need to be changed depending on state law.

- Finally, be prepared to communicate any changes to employees promptly and in writing taking into consideration any state or local requirements governing the timing of pay change notifications.

Need Help?

If you need help sorting out how the final Overtime Exemptions Rule impacts your business, please contact us or call our office at 203.933.1679.