MyCTSavings is a new retirement program sponsored by Connecticut’s Retirement Security Authority. Qualified employers are required by law to join MyCTSavings. The idea is to give all employees a chance to contribute their own money towards their retirement. Unfortunately, it results in more administrative duties for CT small businesses.

MyCTSavings is automatically sending out official registration communications with unique access codes and instructions throughout 2022 and early 2023. When you receive your communication – or if you already have – you will need to go to the online portal at https://myctsavings.com/ and register your business with your EIN and access code. The deadline to register is March 30, 2023.

Who are qualified employers?

Any employer, whether for profit or not for profit, is a qualified employer if:

- It employed five or more employees in Connecticut on October 1st of the previous calendar year, and,

- It paid at least five employees $5,000 or more in taxable wages in the previous calendar year, and,

- It does not currently provide a qualified, employer-sponsored retirement savings plan.

Which employers are exempt?

Employers who are exempt from MyCTSavings include:

- Those who currently provide a qualified, employer-sponsored retirement savings plan such as a 401k, Simple IRA, Defined or Cash balance plan, etc.

- Those who were not in existence at all times during the current and preceding calendar years.

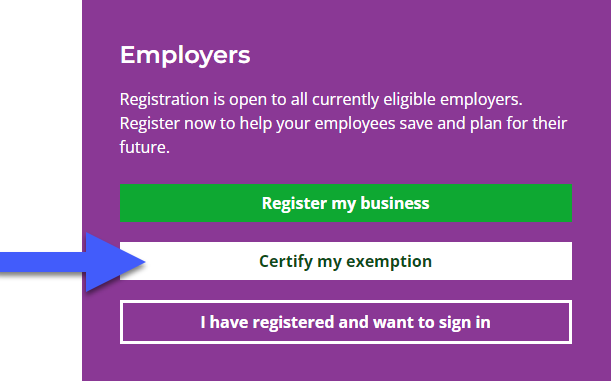

EVEN IF YOU ARE AN EXEMPT EMPLOYER, YOU WILL RECEIVE AN ACCESS CODE AND MUST CERTIFY YOUR EXEMPTION THROUGH THE ONLINE PORTAL (See image below).

Once you certify your exemption, nothing further needs to be done.

What if my company doesn’t offer a company-sponsored plan?

If you do not have a company-sponsored plan, then you are required by law to offer this plan to your employees. Once an employer participates in MyCTSavings, eligible employees must be enrolled. Employees are eligible for an account if:

- They are at least 19 years old.

- They perform services for work within Connecticut; even those that live in other states.

- They have been employed by you for at least 120 days. If they work for fewer than 120 days, you will not need to enroll them.

During the registration process you will enter information about your eligible employees (see registration checklist for list of information to be provided). Once this information has been entered, MyCTSavings will automatically send out official registration communications with unique access codes to all of your eligible employees.

https://myctsavings.com/help-resources/program-resources – Employers select “Registration Checklist.”

Is it mandatory for employees to participate in MyCTSavings?

It is not mandatory for employees to participate in MyCTSavings. Employees will have 30 days from the date of registration to opt out of MyCTSavings. Instructions on opting out are included in the employee registration checklist attached. If an employee does not opt out within 30 days, they will be automatically enrolled and 3% of their gross wages will be contributed to their account by you as the employer. Accounts will be Roth IRA accounts, which are after-tax contributions, i.e., there is no tax benefit to the contributions when made. Tax benefits will be utilized during retirement when the money is withdrawn if the employee meets certain IRS criteria. Your employees must also meet IRS income thresholds to be able to contribute to Roth IRA accounts so your employees must consult their tax professionals to determine if they can contribute.

If the employee does not opt out within 30 days and the employee does not meet the IRS criteria to make contributions to Roth IRA accounts, the contributions will still have to be automatically made by the employer, and your employee will be subject to IRS penalties for contributing to a Roth IRA when ineligible.

We recommend that you meet with your employees to make sure they look out for their individual access codes.

https://myctsavings.com/help-resources/program-resources – Employees select “Auto-Enrollment Notification.”

Processing employee contributions

If you use a payroll processing company, you can consult with them about options for processing employee contributions. If you do not use a payroll processing company, then it will be the employer’s responsibility to withhold and remit the employee contributions. There will be no cost to the employer from the MyCTSavings program, but your payroll processing company may charge a fee to process the contributions.

If you have any questions about the MyCTSavings program, please contact us or call our office at 203-933-1679.